Key European legal sources in the area of fund and market regulation are the Undertakings for Collective Investments in Transferable Securities (UCITS Directive) and the Alternative Investment Fund Managers Directive 2.0 (AIFMD 2.0). Both directives have been implemented in German law in the German Capital Investment Code (Kapitalanlagegesetzbuch, KAGB). They are supplemented and concretized in each case on the basis of authorizations by executive legal acts of the European Commission. This applies, for example, to the further elaboration (Delegated Acts - DA) and the uniform application of the law in the member states (Implementing Acts - IA).

Publications by the European Securities and Markets Authority (ESMA) on the basis of a corresponding directive authorization or its own initiative provide application assistance, and the specifications of the German Federal Financial Supervisory Authority (BaFin) supplement the regulations or monitor implementation at national level.

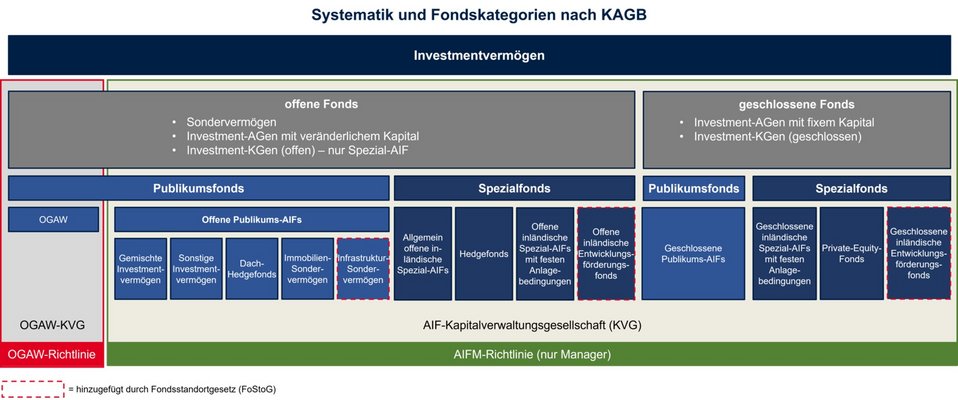

The UCITS Directive concerns investment funds that invest in legally defined types of securities and other financial instruments (securities funds) and also includes product regulation, whereas the AIFMD deals with alternative investments (hedge funds, private equity, etc.) and primarily regulates the managers of these funds.

Together, these two sets of rules form the cornerstone of fund and market regulation.

In addition to the specific and direct regulation of the fund industry through AIFM Directive, UCITS Directive, ELTIF Regulation, EuVECA Regulation, and EuSEF Regulation, there are a multitude of other regulatory areas relevant to this industry, e.g. related to market infrastructure, trading and distribution activities or related services.

These include, in particular, the European financial markets directive MiFID II (together with the MiFIR Regulation), which also contains the relevant regulations on algorithmic or high frequency trading, the European market infrastructure regulation EMIR, which deals with requirements for the parties to derivative transactions, the regulation of securities financing transactions through the SFTR Regulation, the CSDR Regulation for the organization and supervision of central securities depositories, or of course the European short selling regulation, which came back into focus in the Corona crisis and was subsequently adapted accordingly.

Lamfalussy procedure for legislation

EU legislation in the area of financial and securities market legislation, including investment law, is carried out in the so-called Lamfalussy procedure, named after Alexandre Lamfalussy, and is intended to facilitate and accelerate legislation. The procedure has 4 stages:

- Stage 1: Basic directives and regulations are adopted by the Council and the European Parliament.

- Stage 2: The technical details are defined in the form of implementing directives and regulations in so-called comitology committees (experts from the EU Commission and the member states).

- Stage 3: The national supervisory authorities develop common standards and guidelines for uniform material implementation.

- Stage 4: The Commission reviews the implementation of the directives on the basis of comprehensive reports, which the member states are obliged to submit.

The AIFMD regulates managers of alternative investment funds and serves as the EU framework directive, supplemented by the important AIFMD Level II Regulation (Commission Delegated Regulation (EU) No. 231/2013 regarding exemptions, operating conditions, depositaries, leverage, transparency, and supervision).

The directive regulates managers of alternative investment funds that are not covered by the UCITS Directive. It applies to managers based in the EU as well as third-country managers who wish to market their funds within the EU. In Germany, the directive has been transposed into national law through the KAGB.

AIFMD-Review:

The AIFMD underwent a comprehensive review as provided in Article 69 of the directive.

The result of this review process was the amending directive to the AIFMD, known as AIFMD 2.0. It represents a comprehensive revision of the original AIFMD directive and the updated EU legal framework, containing several clear changes compared to the first directive.

Liquidity Management:

AIFMs are now required to demonstrate an appropriate liquidity management system to national supervisory authorities. Open-ended AIFs must implement at least two suitable "LMTs" (liquidity management tools) as outlined in Annex V of the directive. These risk management procedures are designed to ensure an adequate response to liquidity risks and are therefore subject to regular scenario analysis and detailed reporting obligations regarding the results of these analyses to both supervisory authorities and investors. These adjustments aim to enhance the stability of EU financial systems and improve investor protection by enabling AIFMs to better respond to market conditions and redemptions.

Lending by AIFs:

AIFMD 2.0 aims to open up additional financing opportunities for EU-based companies, particularly benefiting those unable to access traditional forms of financing. A key part of this concept includes the changes and associated requirements for AIFs that engage in lending, along with an effort to achieve EU-wide harmonization of these regulations. The goal is to increase the availability of financial resources for EU companies while ensuring enhanced investor protection through limits, specific procedures, and the aforementioned LMTs. For example, AIFMD 2.0 restricts an AIF’s ability to leverage depending on its organizational form, prohibits an "originate-to-distribute" strategy, and bars lending in cases of conflicts of interest, such as prohibiting loans to entities where there is a conflict of interest. Member states have the option to impose stricter regulations ("gold-plating") or to restrict or prohibit lending to consumers.

Depositories and Reporting Requirements:

Following the implementation of AIFMD 2.0, AIFs will be allowed to use depositories located in a different EU member state than the AIF itself. This aims to mitigate the cost risks arising from inefficient processes in EU countries with smaller financial markets, thereby enhancing intra-European competitiveness. However, this privilege comes with extensive and challenging requirements. The affected AIF and all associated entities must provide comprehensive disclosures to both their investors and the national central banks of the individual member states where the AIF is registered.

Additionally, technical and organizational aspects have been adjusted. For example, at least two natural persons who manage an AIFM’s operations full-time must reside in the EU, or for AIFs distributed to retail investors, one member of the AIF’s management must be non-executive and independent. ESG requirements have also been incorporated, which integrate with and refer to the existing SFDR requirements. This means AIFMs must consider sustainability criteria and document them in the relevant guidelines.

AIFMD 2.0 came into effect on April 15, 2024. Transposition into national law in Germany is still pending but must be completed by the legislature within 24 months.

AIFMD 2.0 AIFMD Level II Regulation and list of other executive acts ESMA info page BaFin info page