Investor supervisory law in the fund industry refers to the supervisory regulation of the respective investors themselves.

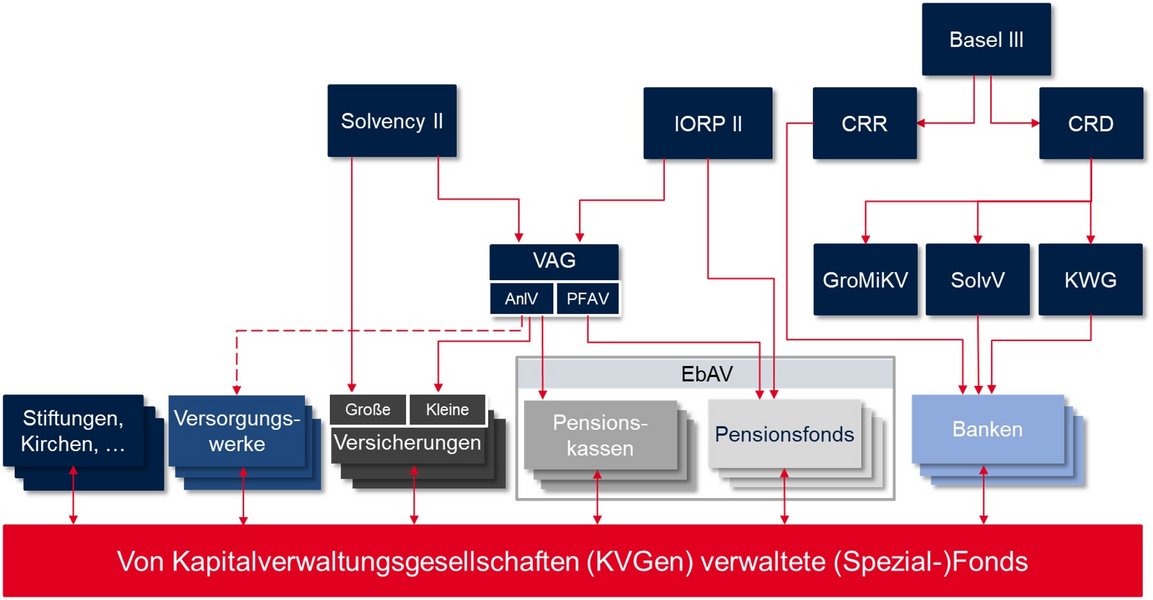

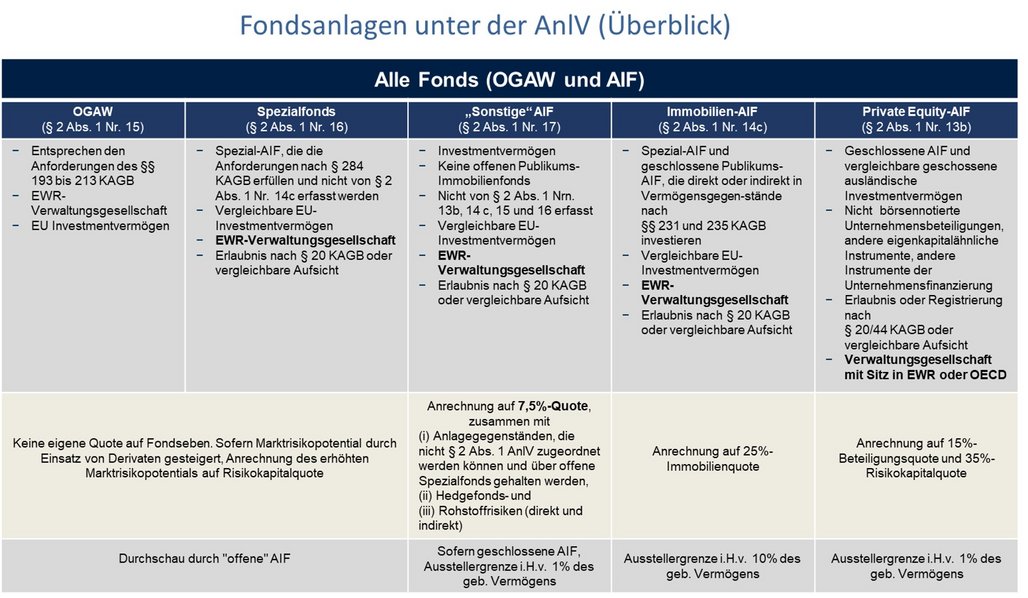

Institutional investors such as insurance companies, pension schemes, credit institutions, foundations or churches are the most important investors in open-ended special funds. They are usually subject to high regulatory requirements themselves in order to protect the respective policyholders, pension scheme beneficiaries or bank customers (or the financial market and financial market stability as a whole). Where the respective investor supervisory law (Solvency II for insurers, CRD/CRR for credit institutions and EbAV II for pension schemes, VAG and AnlV for small insurers or pension funds) sets regulatory requirements, fund companies (capital management companies - KVGs) are indirectly affected by their respective clients: A KVG should know the regulatory requirements of its investors in order to be able to offer suitable products/funds. For example, the KVG calculates the SCR requirement of an investment in accordance with Solvency II, is aware of the eligibility for the quotas or ‘numbers’ of the AnlV and fulfils the investor regulatory reporting obligations to which the investors are actually directly subject.

The following graphic overview illustrates the regulatory network into which investment management companies are indirectly involved via their customers/institutional investors, both at the level of EU law and German law.

Together with pension funds, (large) insurance companies are the most important investors in special funds; around a third of the assets of open-ended special funds, or a good 550 billion euros, come from the insurance industry.

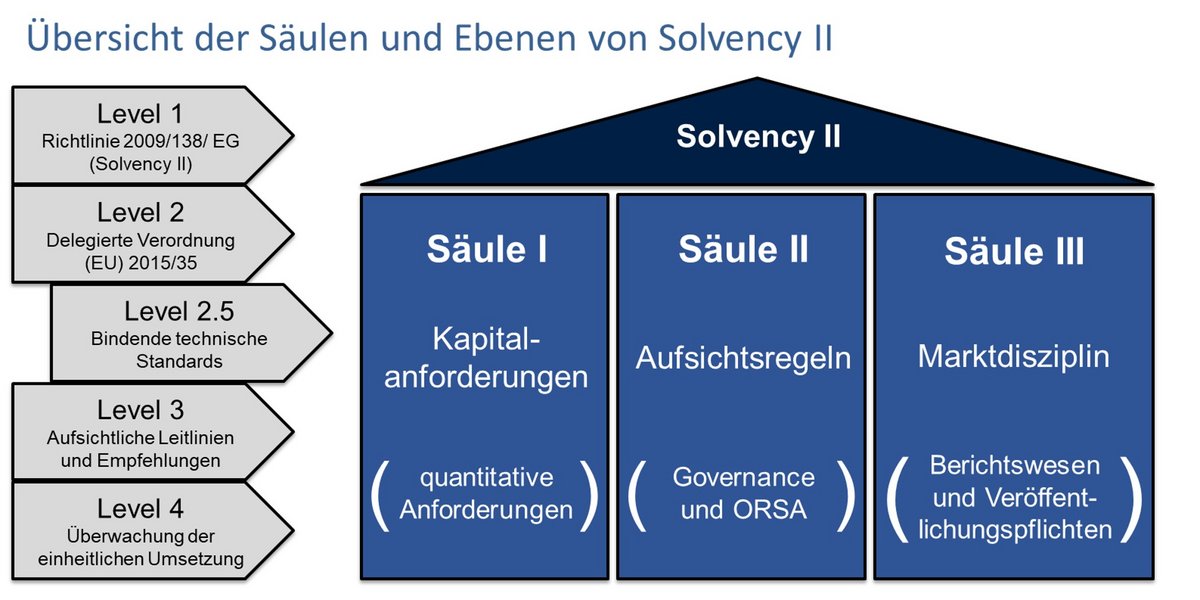

When the Solvency II Directive came into force in 2016, this important market was regulated across Europe. It focuses on risk-based solvency regulations for the capital adequacy of insurance companies and qualitative requirements for the risk management of insurance companies as well as extended disclosure requirements.

The directive follows a three-pillar approach:

- Pillar I concerns the amount of the Minimum Capital Requirement (MCR) and the amount of the Solvency Capital Requirement (SCR) in relation to the Eligible Own Funds (EOF).

- Pillar II deals with the risk management system and primarily contains qualitative requirements, for example regarding the qualifications of the management boards of insurance companies.

- Pillar III regulates the reporting obligations of insurance companies: on the one hand, reporting obligations to supervisory authorities and, on the other, information to be published.

It also contains regulations on the supervision of insurance groups.

In accordance with the Solvency II Directive, insurance companies must comply with the Solvency Capital Requirement (SCR). This standardized EU formula takes into account the main risks of insurance companies' business activities.

The own funds are intended to protect insurance companies from insolvency and ensure that they can honour their insurance contracts and pay out customers even in poor economic conditions. Depending on the type of assets in which insurance companies invest, these must be backed by different levels of equity.

Insurance companies therefore need to know the individual assets they have invested in; if these are bundled in investment funds, e.g. in a special AIF with fixed investment conditions, it is necessary to look through this fund shell. Accordingly, the so-called look-through approach includes the procedures provided for by Solvency II for determining the market risk capital of investment funds.

Solvency II Solvency II Delegated Regulation German Insurance Supervision Act (VAG)

Regulatory Update on Solvency II

In order to meet the requirements as an “interface” between supervisors and insurers and to support insurance companies with the requirements for SCR calculation and reporting obligations, the investment industry of several countries has created the so-called "Tripartite Template (TPT) for Solvency II Asset Data Reporting". This EU fund data sheet supports and improves the exchange of data on the composition of fund portfolios between investment management companies and insurance companies.