Bundesverband Alternative Investments e.V. (BAI)

Key European legal sources in the area of fund and market regulation are the Undertakings for Collective Investments in Transferable Securities (UCITS Directive) and the Alternative Investment Fund Managers Directive (AIFMD). Both directives have been implemented in German law in the German Capital Investment Code (Kapitalanlagegesetzbuch, KAGB). They are supplemented and concretized in each case on the basis of authorizations by executive legal acts of the European Commission. This applies, for example, to the further elaboration (Delegated Acts - DA) and the uniform application of the law in the member states (Implementing Acts - IA).

Publications by the European Securities and Markets Authority (ESMA) on the basis of a corresponding directive authorization or its own initiative provide application assistance, and the specifications of the German Federal Financial Supervisory Authority (BaFin) supplement the regulations or monitor implementation at national level.

The UCITS Directive concerns investment funds that invest in legally defined types of securities and other financial instruments (securities funds) and also includes product regulation, whereas the AIFMD deals with alternative investments (hedge funds, private equity, etc.) and primarily regulates the managers of these funds.

Together, these two sets of rules form the cornerstone of fund and market regulation.

Lamfalussy Process

EU legislation in the field of financial and securities markets legislation, including investment law, is done through the so-called Lamfalussy process, named after Alexandre Lamfalussy, and aims to simplify and speed up legislation. The procedure has 4 stages:

- Stage 1: Basic Directives and Regulations are adopted by the Council and the European Parliament.

- Level 2: The more technical details are laid down in the form of Implementing Directives and Regulations in so-called comitology committees (experts from the EU Commission and the Member States).

- Level 3: Common standards and guidelines for the uniform material implementation are developed by the National Competent Authorities (NCAs).

- In Level 4, the Commission reviews the implementation of the directives on the basis of comprehensive reports, which the Member States are obliged to submit.

AIFMD

AIFMD

The AIFMD is a directive that regulates alternative investment fund managers. It is the EU Framework Directive, supplemented by the important AIFMD Level II Regulation (Commission Delegated Regulation (EU) No. 231/2013 regarding exemptions, operating conditions, depositaries, leverage, transparency and supervision).

The Directive regulates alternative investment fund managers that were not covered by the UCITS Directive. Affected are both managers domiciled in the EU and managers from third countries who wish to distribute their funds in the EU. In Germany, the Directive was transposed into national law in the form of the KAGB.

Level I: Framework directive and framework regulations

Level II: Overview of executive acts

AIFMD Level II Regulation (EU) Nr. 231/2013 and list of other executive acts

Level III: Overview ESMA Updates Q&A and ESMA Guidelines

ESMA Guidelines (Guidelines Tracker; Guidelines with regard to the AIFMD in lines 3 and following):

- Guidelines on reporting obligations under Articles 3(3)(d) and 24(1),(2) and (4) of the AIFMD

- Guidelines on the model MoU concerning consultation, cooperation and the exchange of information related to the supervision of AIFMD entities

- Key concepts of the AIFMD

- Guidelines on sound remuneration policies under the AIFMD

- Guidelines on Article 25 of Directive 2011/61/EU

AIFMD-Review:

The AIFMD is currently undergoing a comprehensive review, as provided for in Art. 69 of the Directive. In accordance with the roadmap, the EU comission published a draft in November 2021, which was subject of public discussion until the end of March 2022, and in which the BAI participated with its committee on fonds and market regulation. The Committee on Economic and Monetary Affairs (ECON) published its draft report on the AIFMD in May 2022, the Council of the EU its position paper in June 2022.

Now the triolgue negotiations between Commission, Parliament and Council has begun. The final draft is due to be published in the first half of 2023, so that the adoption deadline will not expire before the end of 2024.

The draft introduces its biggest novelties on the following topics: Credit funds, outsourcing, non-member countries, liquidity management tools and custody.

The BAI had already contributed to the preparatory survey in 2018. The result and a kind of stocktaking of the effectiveness of the AIFMD adoption was the KPMG report commissioned by the EU Commission, which was presented in December 2018 and published in January 2019 (accessable via: Report on the operation of the alternative investment fund managers directive (AIFMD)).

You can find an overview on the current status of the initative here.

The draft proposal of the directive of the EU Commission can be found here.

The report of ECON can be found here.

The position paper of the Council can be found here.

ELTIF/EuVECA/EuSEF

With the ELTIF, the EuVECA and the EuSEF regulation, specific regulatory acts for special fund product types (so called product regulated EU-AIFs) have been established, which are directly applicable. They encompass European Long-Term Investment Funds (ELTIF), European Venture Capital Funds (EuVECA) and European Social Entrepreneurship Funds (EuSEF).

Level I: Framework-Directives und Regulations

Level II: Übersicht exekutiver Rechtsakte

ELTIF regulation: overview delegated acts

EuVECA regulation: overview delegated acts

EuSEF regulation: overview delegated acts

Level III: Overview ESMA Updates Q&A und ESMA Guidelines

ELTIF-Review:

In Fall 2020, the EU Commission startet the consultation on the ELTIF review process. The consultation deadline ended on January 19 2021. The draft - which was published simultaneously with the AIFMD draft on November 25 2021 - was subject of public discussion until the end of March 2022. In accordance with the roadmap, the Council and Parliament consulted, before continuing with the trilogue negotiations

On March 20 2023, the review found its conclusion with the publication of the reviewd ELTIF regulation. In particular, the need for change of previous participation barriers for retail investors, the restrictive requirements for eligible assetst and diversification, missing facilitations for funds aimed at institutional investors and the inadmissibility of master-feeder structures was adressed. These novelties are supposed to make the previously unpopular ELTIF more attractive.

The key changes can be summarised as follows:

- Expansion of the spectrum of eligible assets for ELTIFs in securitisations (debt instruments, loans and mortgages), financial corporations, real assets without minimum value, clarification regarding the admissability of investments in Green Bonds

- Introduction of fund-of-funds strategies, such as master feeder structures, the possibility of investing in other ELTIFs, EuVECA, EuSEF, UCITS and EU-AIFs with eligible assets on their part; slimming of minimum requirements regarding share quoates in subsidiaries

- Extension of accessible information on ELTIFs via the Public Central Register

- Rise of the market capitalisation requirement of portfolio companies to 1.5 billion EUR (previously 500 million EUR),

- Lifting of restrictions for co-investments of ELTIF managers,

- Lowering of minimum investment in eligible assets to 55% of capital (previously 70%),

- Lowering of diversification requirements through investment target caps up to the total deletion of diversification requirements for ELTIFs exclusively marketed to professional investors,

- Enabling increased leverage: For retail investors up to 50% of net asset value, for ELTIFs marketed exlusively to professional investors up to 100% (previously 30% for both),

- Enabling of retraction of ELTIF shares to fascilitate a secondary market, ESMA appointed to develop Regulatory Technical Standards (RTS),

- Abolishing the liquidation upon request of investors for missing established conditions of retraction,

- Abolishing the suitability test for retail investors based on the ELTIF regulation, instead a suitability test based on MiFID II is always required

- Lifting of miminum investment volume requirements for retail investors (previously minimum 10,000 EUR, but max 10% of total investing assets),

- Lifting of requirement of appropriate investing advice as well as the local operation.

The regulation comes into force on April 9 2023, and is applicable from January 10 2024.

The text of the reviewed ELTIF regulation can be found here.

UCITS V Directive

The UCITS Directive (Council Directive 85/611/EEC of 20 December 1985 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities) defines specific requirements for funds and their management companies.

The UCITS Directive also concerns product regulation. One focus here is the regulation of the permissible assets in which investments may be made. Detailed regulations on this subject are contained in the EU Commission's implementing Directive 2007/16/EC (the so-called Eligible Assets Directive). Changes such as the simplification of the notification procedure for cross-border distribution, the enabling of cross-border fund mergers and the introduction of a new concept of investor information with the basic information sheets (BIB), which replaced the previous simplified sales prospectus, led to a recast of the UCITS Directive as UCITS V Directive 2009/65/EC.

Level I: Framework Directive

UCITS V Directive (consolidated version)

Level II

Implementing Directive 2010/43/EU as regards organisational requirements, conflicts of interest, conduct of business, risk management and content of the agreement between a depositary and a management company

Implementing Directive 2010/44/EU as regards certain provisions concerning fund mergers, master-feeder structures and notification procedure

CImplementing Directive 2007/16/EC on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS) as regards the clarification of certain definitions (so-called Eligible Assets Directive)

Level III

Questions and Answers: Application of the UCITS Directive

- Guidelines on sound remuneration policies under the UCITS Directive (UCITS policies)

- Guidelines on risk measurement and the calculation of global exposure for certain types of structured UCITS

- Guidelines on ETFs and other UCITS issues

- Guidelines on performance fees in UCITS

- Guidelines on liquidity stress testing in UCITS and AIFs

KAGB (German Capital Investment Code) and other national legal sources

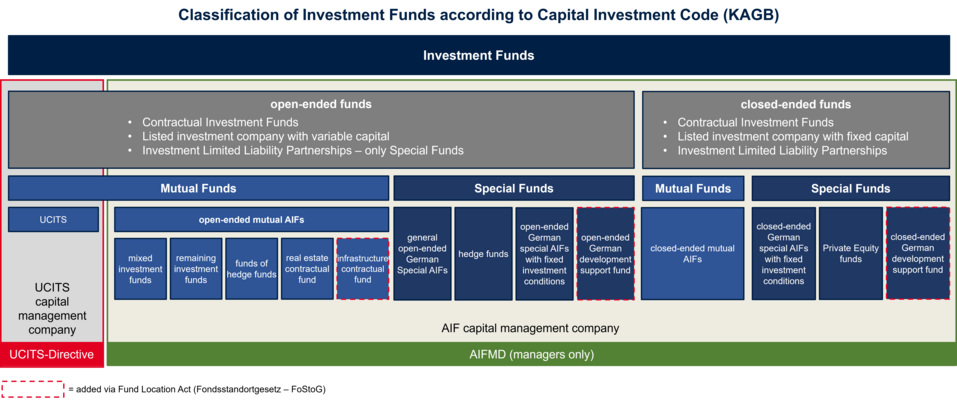

As it is a Directive and not a Regulation, the contents and rules of the European AIFMD are only applicable after transposition into national law. The German Capital Investment Code (KAGB) makes use of the national scope for legal design by deviating from the AIFMD in numerous areas and by making some prescriptions stricter than those of the Directive itself (so-called gold-plating). As a codification of the entire German investment funds’ law, the KAGB not only regulates AIFMs, but also includes rules for UCITS and also regulates numerous types of AIFs.

The KAGB is concretized by executive acts/ordinances of the Federal Ministry of Finance (BMF) and the Federal Financial Supervisory Authority (BaFin). As a rule, the BaFin issues the ordinances instead of the actual ordinance issuer BMF, based on the ordinance on the transfer of powers to issue ordinances to the BaFin. BaFin also provides insights into its current administrative practice through publications such as circulars, Q&As, guidelines etc.

The following chart provides an overview of the KAGB's system and fund categories:

National law

KAGB (German Capital Investment Code) (in German only, there is no convenience translation of this voluminous code)

Legal ordinances of BMF or BaFin

Derivative Ordinance (DerivateV) (in German only, there is no convenience translation)

Capital Investment Audit Reports Ordinance (in German only, there is no convenience translation) Kapitalanlage-Prüfungsberichte-VO (KAPrüfbV)

Investment Accounting and Valuation Ordinance (Kapitalanlage-Rechnungslegungs- und BewertungsVO (KARBV)) (in German only, there is no convenience translation)

Investment Conduct and Organization Ordinance (Kapitalanlage-Verhaltens- und OrganisationsVO (KAVerOV)) (in German only, there is no convenience translation)

Ordinance on the electronic notification procedure (Verordnung zum elektronischen Anzeigeverfahren (EAKAV)) (in German only, there is no convenience translation)

Administrative practice of BaFin (in German only, there are no convenience translations)

Interpretation decisions

Fondsstandortgesetz (FoStoG)

The Fondsstandortgesetz (FoStoG) implements changes mandated by european law from June 2019 in form of the EU regulation 2019/1160 amending the UCITS directive and the AIFM directive as well as regulation (EU) 2019/1156 on cross-border distribution ("Pre-Marketing") and changes to SFDR and EU-taxonomy. Additionally, more changes to the KAGB for the purposes of the de-bureaucratisaion and digitisation of supervision are carried out

The changes made by the FoStoG can be summarized as follows:

- VAT exemption for management of venture capital funds

- tax incentives for employee stockownership plans (ESOP)

- other changes to KAGB:

- Pre-Marketing und distribution in accordance to european regulation; the draft clarifies that Reverse Solicitation (i.e. the initiative of acquisition of funds shares starting from investors instead of management) qualifies neither as distribution nor Pre-Markting

- requirements and effects of revocation

- additional product possibilites:

- closed-end dompestic special AIFs as special assets

- closed-end master-feeder structures

- open-ended infrastructure investment funds

- de-bureaucratisation and digitisation, especially in communication with BaFin

Fondsstandortgesetz (in German)

(Gesetz zur Stärkung des Fondsstandorts Deutschland und zur Umsetzung der Richtlinie (EU) 2019/1160 zur Änderung der Richtlinien 2009/65/EG und 2011/61/EU im Hinblick auf den grenzüberschreitenden Vertrieb von Organismen für gemeinsame Anlagen)

Pre-Marketing:

In line with the new EU-wide definition is Pre-Marketing - made short - the direct or indirect provision of information on investing strategies or investing concepts to potential professional investors based in the eu, to test their interest in a fund which is not yet launched or where a distribution announcement has not yet been made.

Pre-Marketing - FAQ (in German)

BAI, Juli 2021

BAI feedback statements

BAI Stellungnahme zum Referentenentwurf eines Zukunftfinanzierungsgesetzes

May 2023

BAI Comments on proposal to review AIFMD/UCITS (in cooperation with AIMA and ACC)

March 2022

BAI Position Paper on review of ELTIF (in cooperation with AIMA and ACC)

March 2022

Stellungnahme zur BaFin-Konsultation 16/2019, QIN 2017-2019-0001 - Merkblatt der BaFin zum Umgang mit Nachhaltigkeitsrisiken

3. November 2019